AI in Financial Services

By: Ciopages Staff Writer

Updated on: Feb 25, 2023

AI in financial services is emerging as a transformational technology, even though several hurdles remain for artificial intelligence to flourish in the BFSI (Banking, Financial Services, and Insurance) sector.

Artificial Intelligence (AI) and its applications are changing everyday life. It powers what we see online, how we buy products and knows the types of media we enjoy providing accurate recommendations. Consumers are becoming more willing to share their data and expect to be repaid with innovative, personalized products.

The financial services industry is one that needs to respond to the possibilities and embrace AI as a gamechanger.

In a survey of over 150 financial services, the conclusion was that there would be a significant gap between firms that invest in AI and those who don’t. Traditionally, changes in the sector have been slow due to barriers around sensitive data, regulation, and legacy systems. However, new technology such as blockchain, privacy laws like GDPR and CCPA and advancements in cloud computing are alleviating these limitations and making AI into an integral business asset.

This post will look at the main ways that financial firms are using AI as a transformative tool.

What is AI?

Before looking at applications of AI in financial services, it is wise to clarify what the term means today.

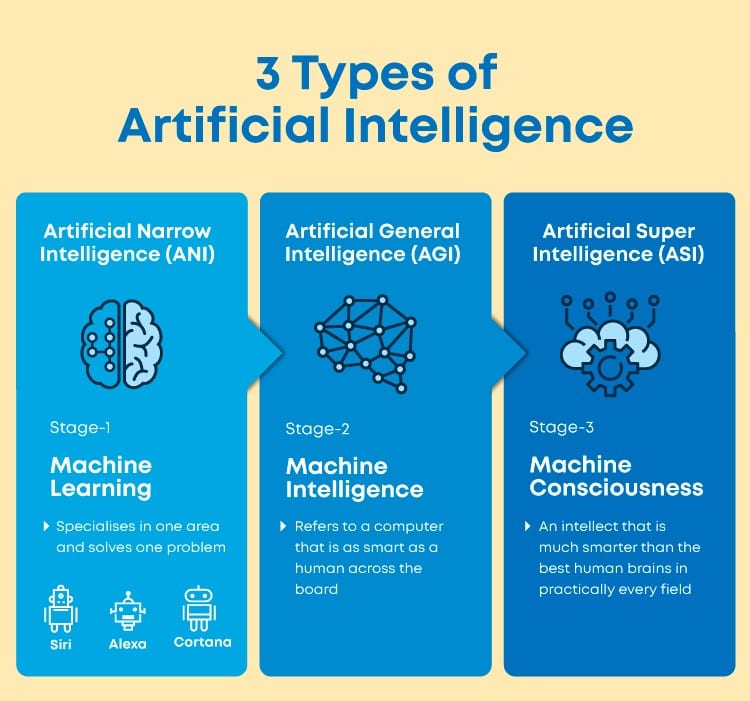

AI can broadly be put broken down into three categories of artificial narrow intelligence (ANI), artificial general intelligence (AGI), and artificial superintelligence (ASI). Right now, we are at a state of robust ANI processes. These are programs that are as competent as a human at carrying out specific tasks, often better than the human counterpart. For example, a recent Facebook AI program learned how to win at poker.

AI can broadly be put broken down into three categories of artificial narrow intelligence (ANI), artificial general intelligence (AGI), and artificial superintelligence (ASI). Right now, we are at a state of robust ANI processes. These are programs that are as competent as a human at carrying out specific tasks, often better than the human counterpart. For example, a recent Facebook AI program learned how to win at poker.

An AGI program is as smart as a human in all capacities. Instead of carrying out a specific task, it attempts to be a carbon copy of the human mind. While experts have made great leaps in AGI, it is still a few years away from being fully commercialized. For example, autonomous vehicles need to have a concept of the world around them to be successful. They need to know how to act if an unexpected event occurs and cannot follow a standard set of rules.

Image Source: GreatLearning:

An ASI program is one which is potentially smarter than humans and can carry out tasks we’d never have imagined would be possible. This is what AI tends to look like in the movies but is a distance from the truth.

We won’t go into more depth on the types of AI in this article, but the key takeaway, for now, is that ANI exists in almost every walk of life, whereas we are still waiting for AGI and later ASI to have their time. Below, we will talk about three use cases of ANI that you could be experiencing each day without even realizing it.

For further reading, Naveen Joshi of Cognitive World talks about seven different types of AI in a Forbes article on this link.

AI in Financial Services – the Use Cases

Predictive Analytics

Predictive analytics is the use of data to make decisions based on the likely future result. One of the best practical examples within financial services is in credit scoring.

With AI, customer credit scoring can be more accurate than ever before. Algorithms will ingest a large volume of to distinguish between applicants who are going to be high risk. A range of variables from different sources will be included. Some institutions have trialed using social media as part of this process, the thought being that it could show signs of how reliable a person tends to be. In situations where there is a limited credit history, social media can enrich the data models.

Ford Motor Company is using machine learning to predict the credit risk of applicants who only have a thin-file history. California based Zest Finance is now known as ZestAI due to the changing nature of their business. They can find solutions using predictive analytics, even when a borrower has no credit information.

AI does not show bias and judgment when it comes to making decisions. Credit is either provided or rejected based on the data given, making the decision more rational than with a human advisor.

Fraud Prevention

Increased usage of digital channels is continually expanding the threat of fraud to financial institutions. Moreover, high profile cases such as Cambridge Analytica have made consumers very aware of the risk of malicious intent online. AI tools offer the perfect solution for combatting and preventing fraud.

Machine learning algorithms can track user behavior and spot patterns that seem irregular to the norm. These algorithms can process vast amounts of data in real-time, spanning multiple channels, creating an effective solution for the growing digital ecosystem.

One such example of an effective AI-driven platform is Kount. The algorithms within the platform can combine millions of transactions spread over various payment providers. When a customer goes to make a transaction, it provides alerts in real-time, giving a risk score. The institution can then make an advised decision as to whether they should accept or reject the transact.

A significant advantage of AI is that it is self-learning. If the algorithm makes a mistake, it can learn from that and correct itself next time.

AI is also assisting the detection of money laundering with similar techniques. Algorithms will alert towards a potentially suspicious activity that needs further investigation. While this does flag customers incorrectly on occasions (known as false positives), it is a far more effective system than manually checking through lines of data.

Trading

Machine learning algorithms are being used to drive investments and create automated trading platforms. The sophisticated models can look at data from several sources and make recommendations and predictions as to the likely success of an investment decision. There are a few benefits to this against traditional trading processes.

Firstly, AI frees up the human advisor to spend more time dealing with customers and less time having to sift through and analyze data. The decisions come to them to offer the customer proactively, making it a much smoother process for everybody involved.

As well as that, the volume of data that algorithms can model is far more extensive than any human would ever be capable of processing. Algorithms are not only making faster decisions but also more accurate ones by incorporating more sources of information.

The decisions made by AI don’t have any bias or “gut feel” attached to them. A human can be influenced by external factors such as how they feel about a company, perhaps, putting them off investing. AI looks at the data and only the data. Investors receive a decision devoid of emotion, which is likely to be a safer bet.

Bloomberg is already using AI to predict the market and forecast future trading patterns. They can identify behaviors quickly and accurately for traders to make the right investment choices.

AlphaSense is a market-leading technology platform for trading. It uses a form of AI called natural language processing (NLP) to analyze words in transcripts, research and news to predict financial events. For a human to review the same volume of information would take weeks as opposed to seconds.

Conversational Chatbots

The term “Chatbot” has become quite commonplace in the world of customer service in recent times. A Chatbot is a computer program that can communicate with humans using AI and Big Data. Some are so good that it is hard to differentiate between humans and machines. The most common in our day to day lives are Alexa, Siri and Google Home, to name a few. In short, they take text or speech, convert it to data and provide an appropriate response.

Finance can be a complicated subject, and customers often find themselves needing to talk to somebody. Institutions have typically managed this by having high numbers of telephony service teams at hand. However, this is not cost-effective, and many of the questions they need to answer are simple and rule-based. For example, customers call to ask for their current balance. This takes time for a representative to respond and they could quickly obtain the answer via a digital channel.

Chatbots are perfect for responding to those simple rule-based queries, allowing financial staff to focus on the more complicated customer problems

There are lots of examples of chatbots in financial services today. Allianz has a bot that offers 24/7 online assistance named Allie and Mia answers questions or the Co-op Banking Group.

Erica is one of the most successful applications in banking to date. The smart bot from the Bank of America can offer assistant and advice to customers across a wide range of their services.

Customers prefer digital communication methods, and it’s the right time for financial services to be

part of that trend.

AI in Financial Services – What’s next?

This post has covered some of the significant ways in which AI is transforming financial services. A quick Google search will bring up plenty of banks and other firms that are now using AI to their advantage. New technology will only continue to reshape the landscape. Unprecedented events such as Covid-19 have shown how important it is to have automation in place, at a time where human resource is limited or unavailable.

Of course, similar to what AI is facing in healthcare, several hurdles remain, including mitigating the bias in AI.

We are only at the start of the journey for AI in financial services. At the end of the next decade, with greater adoption of cryptocurrency and other AI methods, we will be looking at an entirely different world.