Finance Software Technology Trends

By: Ciopages Staff Writer

Updated on: Feb 25, 2023

Finance Software Technology Trends: The future of finance and accounting is going to be significantly affected by finance software technology trends and where the platforms evolve towards. The implications of these technology trends are significant. With ever-increasing demands on the finance function, many companies are transforming their accounting and finance technologies and knowing the finance software technology trends will allow better planning and informed decision-making

Summary of Finance Software Technology Trends:

March to the Cloud

The biggest change to come to finance and accounting today is the migration to the cloud. Today, a wave of new SAAS (Software-as-a-Service) solutions, such as Workday and NetSuite, and the traditional platforms all have cloud offerings. Some companies are worried about data security, and justifiably so, but the acceptance of cloud-based finance software technology has increased over the last several years.

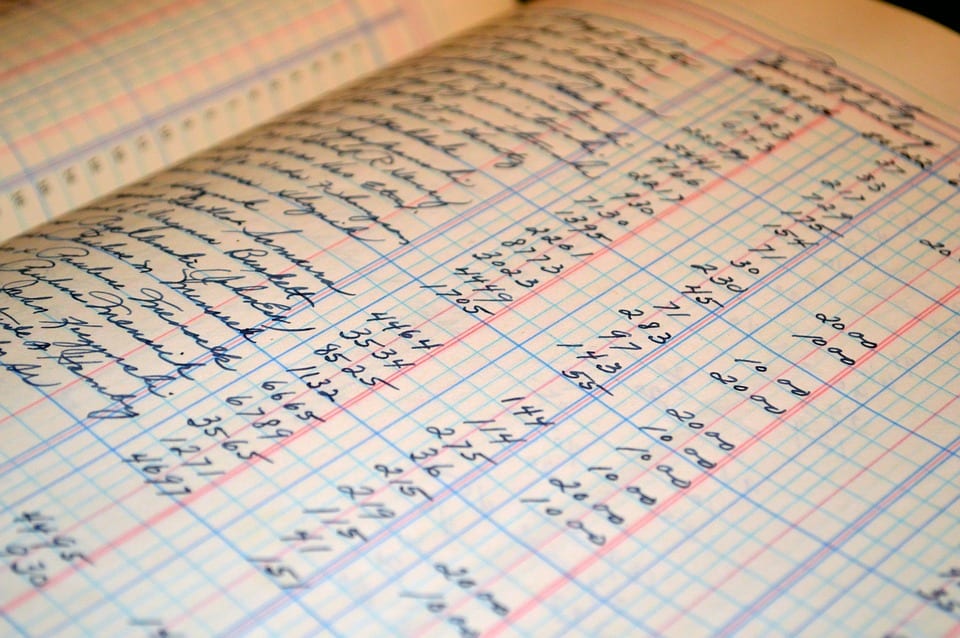

The Digitizing of Financial Data

Financial data is going digital, and that is allowing CIOs and CFOs to work with it in ways that they may not have thought possible in the past. Digitization helps in improving speed, accuracy, and real-time visibility.

Automating Accounting Tasks

Some accounting tasks can be tedious, and when there is a lot of tedium and repetition, there is a higher level of room for error. By automating some more mundane accounting tasks, the chance of a mistake being made drops drastically.

Algorithms and Vast Data Sets

With the right algorithms, data sets can be sliced and diced to glean insight. CFOs are responsible for providing the correct information for strategic decision-making, and concepts like machine learning and big data analytics have pushed the envelope in this regard.

Refining Forecasts for Future Decisions

Another important aspect of technological advancements for finance and accounting is that estimates can be refined faster and more efficiently. That allows for future decisions to be made with all the data that is needed to make them. This can help reduce the chance of guesswork and can make it easier for companies to plan. Forecasting requires some assumptions by default, but the more information that is available with which to make that forecast, and better the tools are crunching and munching the data, the more accurate the forecast is likely to be.

Regulatory Compliance

Compliance matters, especially in financial and accounting transactions. Even an honest mistake can cause a high level of trouble for a business that provides information to others on which the decisions of those others are based. Technology is enabling better compliance with concepts such as automatic triggers, data analytics, forensics providing the necessary support to stay in compliance.

What’s Next?

For CIOs and CFOs, the decision is whether to use the new technology or not. If they fail to do so, they and their companies will likely be left behind, since many other companies will embrace the new technology and use it to its fullest extent. The B2B customers of these companies will see that and will work with the companies who are up-to-date with the latest technological advances. To stay relevant in a fast-paced and rapidly changing financial and accounting world, taking charge of cloud-based technology options and understanding their implications will be a vital part of continued advancement for a CIO or a CFO. The future of their companies may depend on the technological choices they make.

Are there other finance software technology trends that are important? Let us know.

Please check out the CIOPages.com finance transformation resources.

-

Finance Capability Model

U.S. $699 – U.S. $1,999Category : Capability Models

View Product This product has multiple variants. The options may be chosen on the product page