Accounting and Finance Transformation Roadmap

By: Ciopages Staff Writer

Updated on: Feb 25, 2023

What is an Accounting and Finance Transformation Roadmap?

An Accounting and Finance Transformation Roadmap is a compass to get your enterprise from the point of departure to the point of arrival, by taking a set of actions, activities and achieving some outcomes, in a planned sequence. Accounting and Finance Transformation, as the word “transformation” implies, is more than just band-aid to fix a process of a system issue. An actual finance and accounting transformation shall be dependent on strategic and operating model considerations. And, in today’s dynamic environment – where technology advances are driving business model changes, regulatory frameworks are imposing significant burdens, and the pace of change is accelerating – it is imperative that finance and accounting functions leapfrog from keepers of historical records to strategic decision support and operating model enablers.

Accounting and Finance Transformation Roadmap Components and Journey:

Various Facets of Finance and Accounting:

Finance and Accounting are not just a simple or monolithic function. We can categorize the key sub-functions of finance and accounting as follows:

Finance as a Strategic Enabling Function:

- Long-term planning

- Strategic level Project budgeting

- Growth path alternatives analysis

- Management accounting

- M&A and divestiture support

- ROI Analysis on significant, strategic investments

- Optimal financing (to lower average cost of capital and hence stakeholder value)

- Risk management

Finance as a Back-Office Service Provider:

- General Ledger

- Accounts Payable

- Accounts Receivable

- Payroll

- Cash management

- Revenue accounting

- Credit management

Finance as a Business Enabler:

- Pricing analysis

- Business intelligence and decision support

- Forecasting

- Budgeting

- Profitability and margin analysis

- Working Capital management

- Management reporting

Finance as a Control Function:

- Internal Audit

- Regulatory reporting

- Compliance management

- Internal controls

- Policies and procedures and guidelines

- Stress testing and business reviews

The Drivers for Accounting and Finance Transformation:

An Accounting and Finance Transformation Roadmap is a compass to get your enterprise from the point of departure to the point of arrival, by taking a set of actions, activities and achieving some outcomes, in a planned sequence.

There are many internal factors and external trends that make a Finance Transformation a strategic imperative. Typical external drivers for F&A transformation tend to be regulatory burdens, shifting competitive dynamics, evolving business climate and increasing expectations from the finance and accounting functions. And internal drivers for a finance and accounting transformation range from lack of sufficient controls to delays in financial close, lack of visibility into operations to ineffective working capital management.

Acknowledging the Need for Transformation:

To embark on the process of building a finance and accounting transformation roadmap, it is essential that the CFO and his/her compatriots realize and acknowledge the need for transformation. It is important for the top management to distinguish ongoing operational and process improvements from the fundamental need to rethink. For example, continuous improvements, such as Kaizen, are the typical evolution of the finance and accounting function. However, a reimagination of the operating model, the re-engineering of core processes, and the major re-architecting of the systems are when a finance and accounting transformation roadmap is warranted.

Seeding the Accounting and Finance Transformation Process:

Once there is a realization that accounting and finance transformation is warranted, the next step is to establish a core team and fund the initial efforts for creating the transformation roadmap. At this stage, what is needed are strategic thinkers and operational experts who can envision what’s “Next”. The change program is still at a conceptualization phase, not an execution phase.

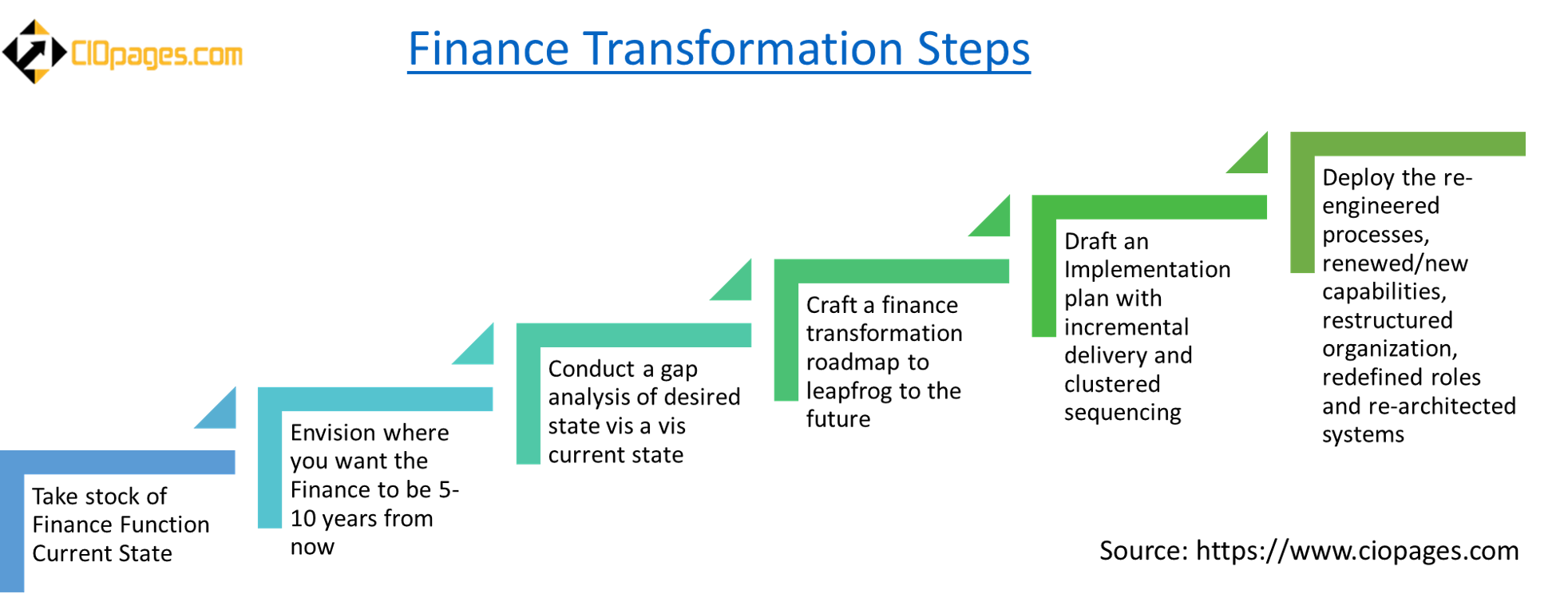

Here is an approach to crafting an Accounting and Finance Transformation Roadmap:

Compile the Goals, Objectives and Desired Outcomes:

Based on the strategic imperative and internal drivers, document what are the key goals, objectives and desired outcomes you are striving for. This could be about controls or compliance, managing cost of capital or enhancing merger integration processes. Knowing these high-level objectives will help frame the context for the transformation roadmap.

Typical Deliverables:

- Internal factors

- External drivers

- SWOT analysis

- BHAGs (Big, Hairy, Audacious Goals)

Document the Current State:

Documenting the current situation can be a multi-dimensional effort. The important thing to understand here is what depth do you need to go? If there is a consensus that the transformation is not about a step function improvement, but a leapfrog, then the current state may not be a material factor. In such case, one can get away with anecdotes and interviews to summarize the current situation.

Or on the other hand, if the goal is to not to repeat the history and to understand the details and depth of the current state are valuable, it may require documenting current state processes, the inefficiencies, and bottlenecks. This exercise, while valuable, also will be time-consuming and expensive.

Typical Deliverables:

- Current state process analysis

- Current state of technology analysis

- The present state of people analysis – competencies, capacity, etc.

- Current state legal, compliance and risk analysis

Envision the Future State:

Future state envisioning is a major step in setting a marker way into the future. The future state process should be unencumbered by the current state systems, processes, and people. It should be a blue-sky picture of an ideal state. (Of course, this will be tempered later regarding cost-benefit analysis and realization realities.)

Typical Deliverables:

- Future state vision

- Scenario Analysis and Wargaming

Conduct Gap Analysis:

The ideal target state defines your point of arrival, and the current is your point of departure. The gap analysis shows how much of a chasm do you need to cross before you can reach your desired state.

Typical Deliverables:

- Gap analysis between current state and the future state

- Quick Wins

Evaluate Alternate Approaches:

Understanding that there are alternative approaches to transformation and assess the options dispassionately is an essential step in crafting a finance and accounting transformation roadmap. For example, despite prevailing cultural norms, outsourcing may be the best bet for a function. In addition to discussing the approach a high-level ROM (rough order of magnitude) estimates of cost, effort and complexity would be valuable. Similarly, a high-level listing of potential benefit streams – qualitative and quantitative will provide a balance to the expenses.

Typical Deliverables:

- Strategic options and analysis

- Solution options and analysis

- ROM cost estimates

- High-level benefit streams per option

Select the Recommended Path:

A target operating model is a blueprint of the future state functions, processes, people and information as levers to accomplish the new business state.

The recommendation from the project team should be based on several considerations – cost, effort, complexity, the result. The recommended path should ideally comprise of a target operating model. A target operating model is a blueprint of the future state functions, processes, people and information as levers to accomplish the new business state. Much of this is based on high-level estimates and several assumptions, but that is what is typically the case in real life – decision making with a lot of ambiguity.

Typical Deliverables:

- Options comparison and recommendation

- Analysis of the recommended path – risks, rewards and realization framework

Craft a Finance Transformation Roadmap: The detailed finance transformation roadmap will typically consist of a full quarter by quarter activities, outcomes and milestones for the first 24 months, and then for subsequent years an annual phased roadmap items. Typically, the transformation roadmap will comprise of high-level work streams and phases so that incremental delivery is possible.

Typical Deliverables:

- Transformation roadmap with gradual and sequential deliverables

- High-level work streams and structure

What about the business case?

A business case – both qualitative and quantitative – may be necessary for each of the three stages. Stage one shall be focused on the initial funding to evaluate the value and viability of a transformation. Stage 2 business case is during the recommendation of the transformation approach. Step 3 business case can be at a workstream level.

What’s next?

Of course, the finance transformation roadmap is a strategic deliverable. The real work will start soon after that in various projects and work streams. And another important thing is Change Management. Those topics are out of the scope of this article.

To jumpstart your efforts, please check out the finance and accounting transformation toolkit. And here is a sample finance and accounting transformation business case and roadmap. You may also find other transformation resources including insights and templates in the finance and accounting transformation resources.

-

Finance Transformation Toolkit

U.S. $749 – U.S. $2,249Category : Transformation Toolkits

View Product This product has multiple variants. The options may be chosen on the product page