Finance Transformation Approach

By: Ciopages Staff Writer

Updated on: Feb 25, 2023

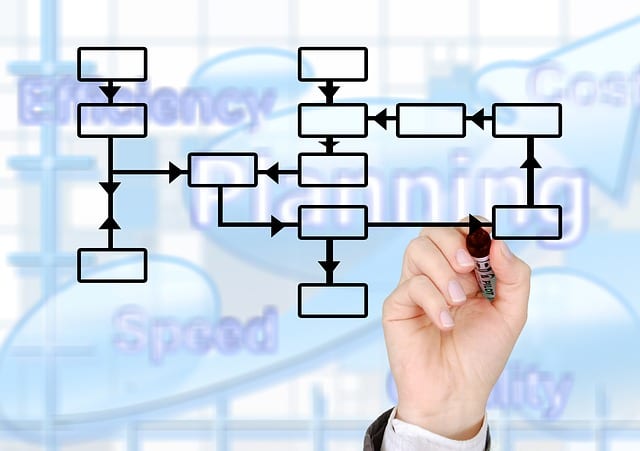

Accounting and Finance Transformation Approach: As the economic climate continues to evolve and expand and become dynamic, so does the need for finance and accounting transformation. Accenture estimates tremendous cost savings and efficiency gains. When embarking on an Accounting and Finance Transformation, it is of the utmost importance that CFOs stick to a strict implementation strategy to help ensure the process is carried out both effectively and efficiently. From phasing out past legacy systems to data migration and pilot releases, there are numerous steps involved in transformation procedures. Let’s take a look at six steps your organization should consider as a potential finance and accounting transformation approach. It is important to remember that the transformation is never really complete as finance transformation is constantly evolving.

Accounting and Finance Transformation Approach

Develop a well-planned strategy

First and foremost, CFOs must develop a strategy according to the context of the organizational structures they are working for, which means the following questions need to be answered:

- According to the various roles in the company, how should the company’s finances be handled?

- How can the finance strategy become an extension of the corporate strategy?

- What are skills and competencies needed to progress in the finance transformation?

- Where is the balance between service levels and the accompanying expenses?

- What technological updates does the organization need to implement?

Develop blueprint of key operational processes and future state

An end-state vision developed in the form of a blueprint can greatly improve the organization’s efforts toward staying focused on finance transformation. This blueprint should be fairly detailed, outlining all elements of the company and its service delivery models. Also within the blueprint should be defined characteristics and features that are pertinent to the future-state finance function of the organization. Other specific elements to include are:

Let’s take a look at six steps your organization should follow when implementing an accounting and finance transformation, and it is important to remember that the transformation is never really complete as finance transformation is constantly evolving.

- Transactional processes

- Specialty and decision support practices

- Organizational alignment

- Talent and technology requirements

Obtain Executive-level Support

CFOs will greatly benefit from executive sponsorship throughout finance transformation because it helps to ensure the entire organization is involved and able to navigate through any barriers that present themselves. When executive-level support is not obtained, transformation attempts often fail. In addition to this type of support, transformation team members should be well-stocked with appropriate resources to ensure they are able to perform the transformational assignments they are given.

Begin with a pilot project

To provide a proof-of-concept to the finance transformation team, a pilot project can be of immense value. Proposed changes can easily be viewed and experienced during a pilot project and this tactic provides a low-risk opportunity for the transformation team to gain credibility within the organization. Once the pilot project has been completed, CFOs can use insight-driven decision making to decide whether to push the rest of the transformation process through or move toward developing a different approach. The key aspect to remember about pilot projects is that they have their own place in the context of transformation; if they are not managed correctly, this can lead to a succession of accumulative events that disrupt the transformation process.

Active management of transformation change

The finance transformation is going to have an impact on the entire organization, making it extremely imperative that a robust change-management process is initiated and maintained. The actual success of the transformation will be dependent on both the technology used and the people using the technology. Other factors affecting the success of the transformation and the change it brings about to the organization include:

- Capabilities of leadership

- Training of staff facilitating the operations

- Satisfaction of customers

- Transition planning

- Stakeholder management

Understand it never ends

Finance transformation is never complete; this is why organizations must be content with “reaching a new normal.” As the status quo evolves, so must continuous improvements, and these improvements must be applied on a daily basis to make sure they advance as the company advances in structure and operational processes. When a transformation process is laser-focused, this helps improve the entire process, especially for multinational organizations, giving them a strong ethical advantage for underpinning growth and building strong customer relationships. Reaching this type of normalcy is key to being content with the transformation taking place that will continue to be ongoing and always changing.

Did we miss any critical factors in accounting and finance transformation approach? If so, please share your point of view.

If you wish to seek help in defining your finance transformation business case and roadmap, please contact CIOPages.com. With our customizable deliverables, we can accelerate time to value.

-

Finance Transformation Toolkit

U.S. $749 – U.S. $2,249Category : Transformation Toolkits

View Product This product has multiple variants. The options may be chosen on the product page -

Finance Capability Model

U.S. $699 – U.S. $1,999Category : Capability Models

View Product This product has multiple variants. The options may be chosen on the product page